Finance

FTX Paid A New York Law Firm $12M Before Bankruptcy Filing

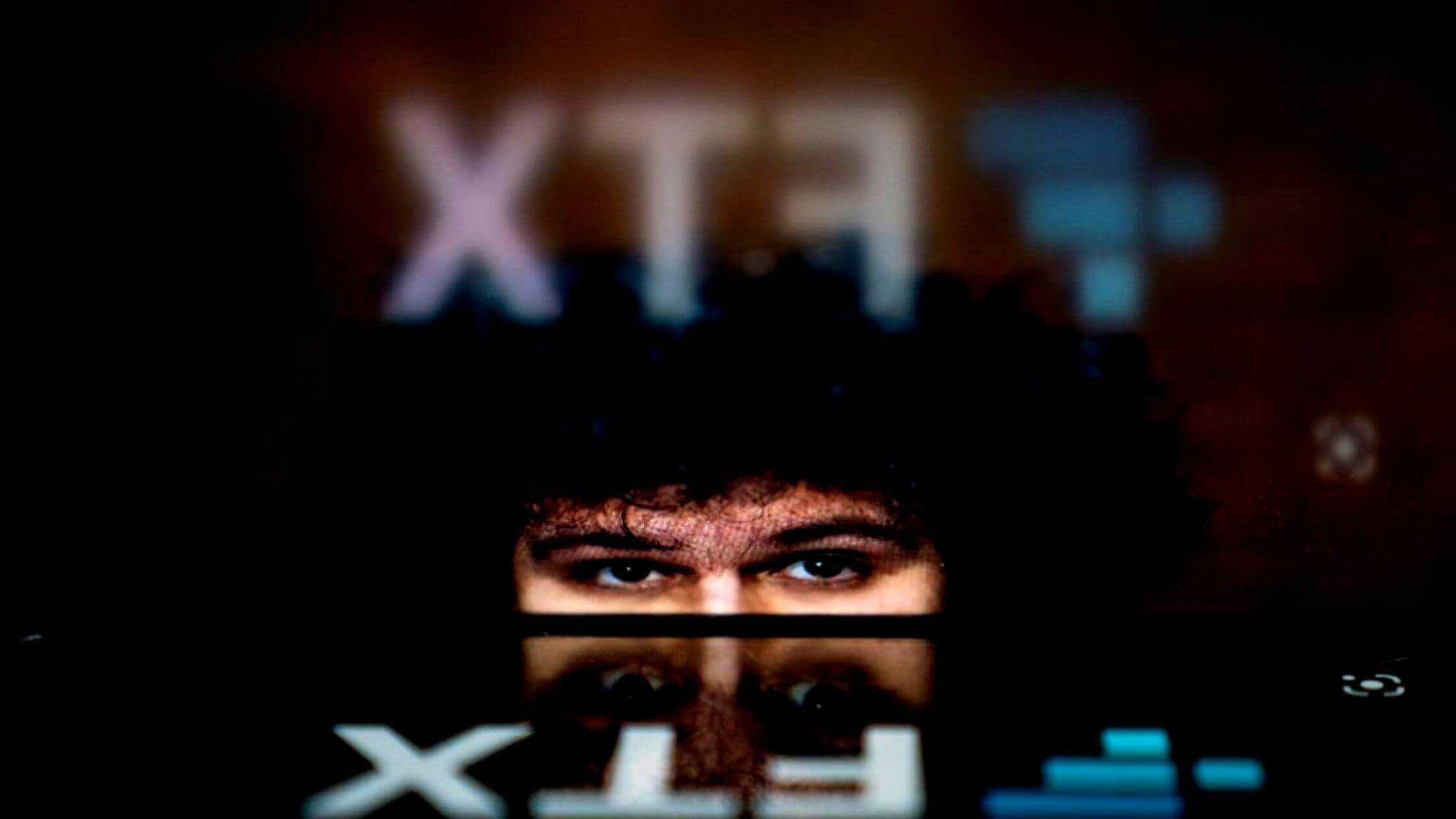

The crypto exchange platform FTX filed for bankruptcy on November 11, after the former CEO and his top associates were charged with fraud cases over looting $8 billion worth of FTX’s customer’s wealth.

The reports entertain that FTX Ltd. has paid $12 million to Law firm Sullivan $ and Cromwell to handle the early stages of the closely watched chapter 11 case.

The law firm received the entire $12 million from an FTX-controlled company west realm shires services inc. shortly before filing the bankruptcy.

According to the reports, the filing shows that the firm has already drawn around $3 million, for the work done for filing bankruptcy.

FTX Paid Nearly $3.5 Million Over The Past 90 Days

Since August, before filing the bankruptcy FTX paid nearly $3.5 million over the past 90 days, most of which was paid on November 3. It is estimated to be paid at least $15.5 million. Among this, S&C holds nearly $9 million of the amount.

Staff at the legal advisory of Suvillian $ Cromwell charge an hourly rate of $2,165 for the special counsel, court filings, and other legal advice. According to the court filings, the firm received about $3 million from October 19 to November 3

FTX and its board of directors are also working with Quinn Emanual’s lawyers, seeking special counsel in a litigation capacity, and looking for the legal claims for the bankruptcy to be brought For filing, the firm received about $575,000 in three months before filing the bankruptcy.

Another set of lawyers from Landis Rath & Cobb received $300,000 for the FTX before 3 months of filing for bankruptcy. Restructuring specialists Kroll, and Tax advisors at Ernst and young will all claim their stake according to the filings.

As of now, the company’s unauthorized management has led to driving away millions of FTX’s investor’s dollars from the company.

In early November, FTX fired criminally charged Sam Bankman Fried and rushed to reorganize the fallen hundreds of FTX-related companies by filing chapter 11.

Sullivan & Cromwell was a part of a group that pushed with extreme pressure to file chapter 11, before Sam Bankman Fried’s testimony before congress.

Before reorganizing the company, Quinn Emmanuel and Sullivan & Cromwell used to work with FTX on other legal matters.

Before filing for bankruptcy, FTX paid $8.5 million in legal fees for acquisition transactions and specific regulatory inquiries relating to certain U.S business lines, according to S&C.

Quinn Emmanual received $500,000 from FTX in April as the beginning of an agreement that would send $100,000 free per month to the law firm, according to the law firm filed in the court document.

The law firm has represented Alameda research in blockchain and cryptocurrency disputes; advised FTX on intellectual property disputes, and guided FTX on reorganizing advice related to chapter 11 cases.

>Related: Ellison Admits Misleading FTX Lenders Along With Bankman-Fried

In a previous statement, Quinn Emmanuel previously signed an engagement letter with Sam Bankman, but the legal firm has not performed any legal services for him as now he is neither a client nor a client in the FTX.

To this list of lawyers, nine-member from paul Hastings are hired as a representative committee to work in the FTX.

In a fresh development, district judge Ronnie Abrams revoked her participation in the FTX case after revealing that her husband working in a law firm as a partner, had advised the crypto exchange platform back in 2021.

According to Ronnie Abrams, she doesn’t want to leave any door for the speculations or conflict of interest to rise even though her husband was not involved in any of these cases.