Finance

Centralized Vs. Decentralized Exchange: Which One Is More Effective?

Most of us might have heard of stock exchanges. These exchanges act as platforms to facilitate the trade and business of bonds and securities.

But if you are looking forward to buying or selling your crypto assets, you will first require access to the crypto exchanges. These exchanges offer multiple crypto coins, tokens, and assets to trade.

Two main types of exchanges are operational for the time being: Centralised and Decentralised crypto exchanges.

Before proceeding, it is essential to understand in detail the nature of these two types of exchanges and how they differ. This will help the investors to channelize their investments profitably.

Furthermore, the two exchanges offer a different level of security and protection to the otherwise volatile nature of the cryptocurrency. Therefore, the following explanation will help to clear off the doubts related to this form of trade.

Centralized Crypto Exchange

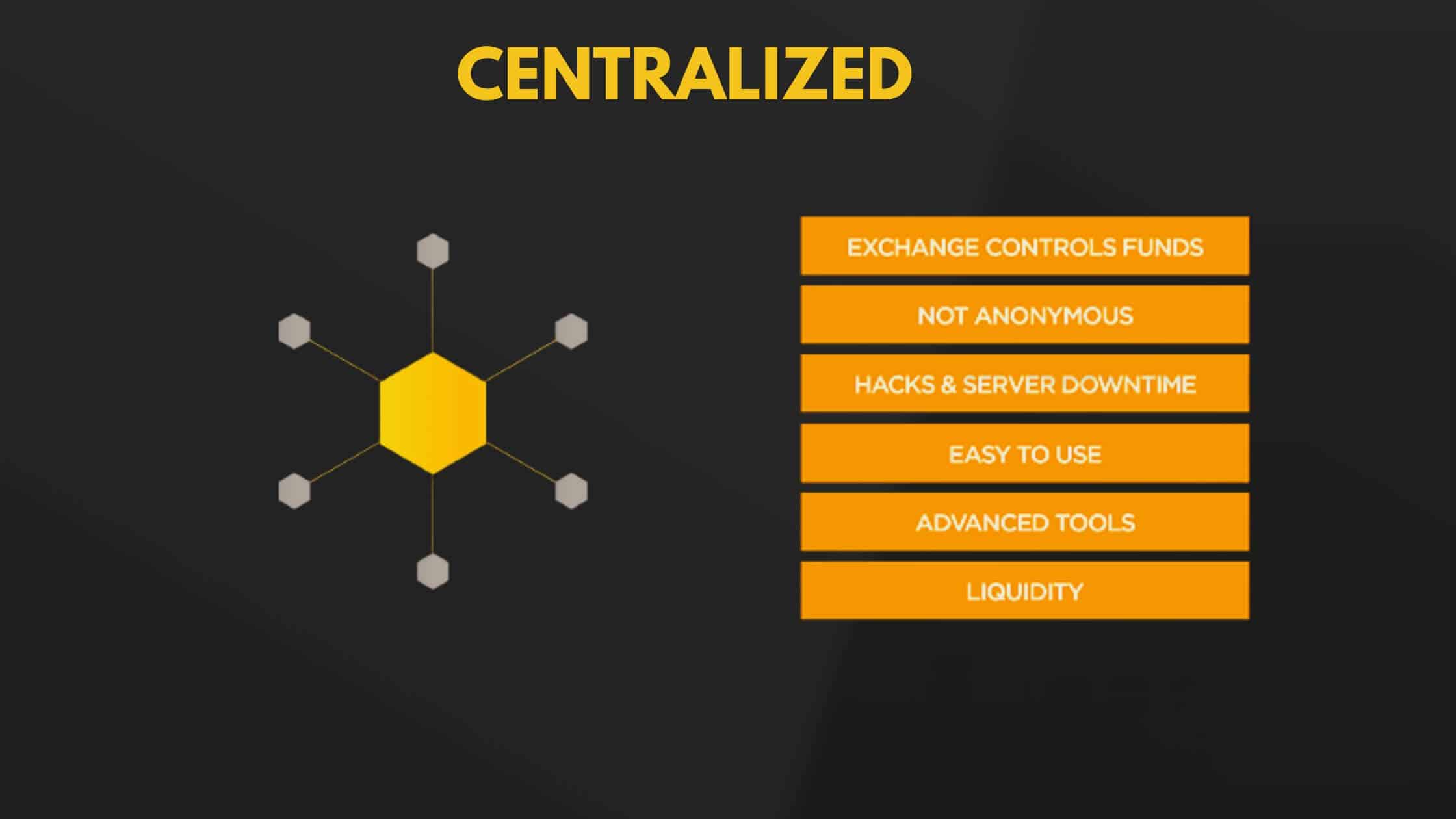

A centralized crypto exchange is a one-stop destination to exchange cryptocurrency at a profitable bargain. They act as an intermediary between the buyers and the sellers.

They are usually called custodians and brokers for settling every transaction. Therefore, these centralized crypto exchanges rely on a third-party network to confirm the safety of the transactions.

Investors willing to invest in crypto initially deposit the required amount in an account with this third party. The party then analyses the transaction within a specified period to ensure that the transaction is compliant with regulations and is safe.

Meanwhile, the exchange acquires the investor’s personal and official information to verify the transaction’s authenticity. Investors are expected to support these formalities to boost the credit score on the exchange.

The entire procedure is enforced to reduce the chances of speculation and unauthorized transactions in crypto. This helps to control unauthorized trade in crypto-based assets.

However, these exchanges are based on compliance with federal rules and regulations and, therefore, are expensive to operationalize. Furthermore, the excessive reporting norms can delay the trade, due to which many profitable bargains would be lost.

Decentralized Crypto Exchange

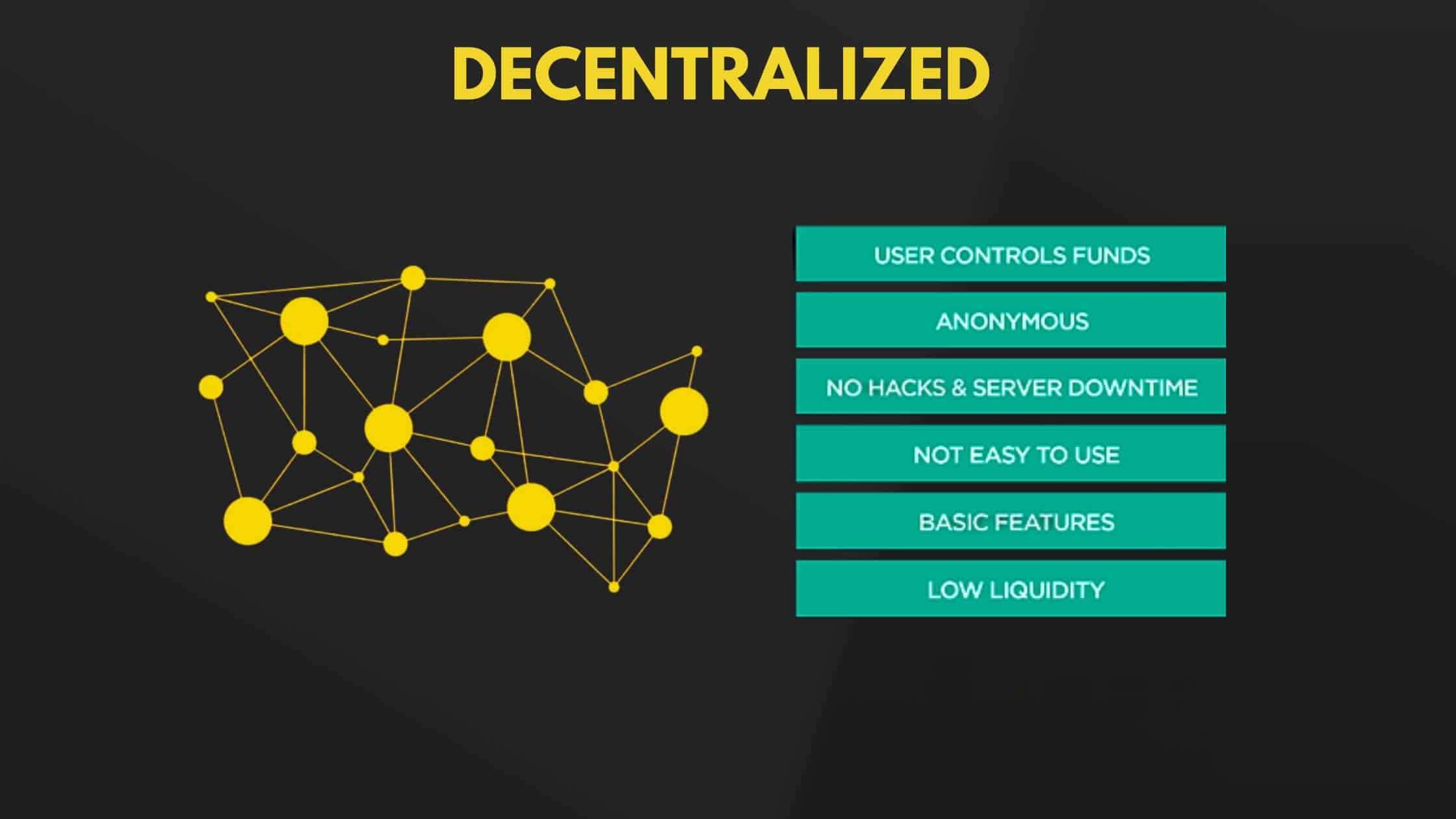

A decentralized crypto exchange is an independent platform that mitigates the gap between the demand and supply of crypto assets. They do not depend on any third party or act as an intermediary between the buyers and the sellers.

Instead, traders can transact the transactions with the help of smart contracts and self-executable wallets. These exchanges are based on blockchain.

These exchanges function in the most hassle-free manner. Traders can independently handle them. The traders are not even required to share their information with any third party for verification.

The transaction remains confidential and protected till the time it is executed. The decentralized crypto exchanges ensure the timely and inexpensive settlement of the bargains. They offer the most convenient platform, to begin with, to the investors.

The users can deal with their assets in the way they want to. There is no requirement to seek permission before initiating the trade. They are built on open-source platforms.

The exchange of crypto assets takes place only after complying with numerous regulations and norms. These types of exchanges offer the easiest way to trade in crypto.

Decentralized Crypto Exchange Vs Centralized Crypto Exchange

As already observed, both of these exchanges operate differently. They are distinct on various points of difference. The list of these variations has been given in the following way:

Safety

Both of these exchanges offer different levels of security to traders. While the centralized crypto exchange complies with security norms, the decentralized crypto exchange provides a better security cover.

They have to be more secure as there is no need to rely on a third party. The transaction remains exclusively between the buyers and the sellers. There is no exchange of information for trading in the decentralized crypto exchange.

Demand

The centralized crypto exchanges are operational on a large scale. It was the first type of exchange that was launched. However, after the advent of decentralized crypto exchange, reliance on the former has been reduced.

Decentralized crypto exchanges are becoming very popular amongst investors for convenience.

Ownership

When it comes to the centralized crypto exchange, a third party is ipso facto involved in the transaction. The control of the transaction is distributed between the trader and the third party. The investor cannot trade in the way he wants. Each trade is subjected to compliance with norms and conditions.

However, with a decentralized crypto exchange, it becomes feasible for investors to retain control over their accounts and assets.

They are responsible for deciding the destiny of their trade. They decide when to buy, sell, hold and deal in crypto assets. Furthermore, the traders are not obligated to adhere to the guidelines established by third parties. This offers autonomy which is otherwise absent in centralized crypto exchanges.

Cost

The centralized crypto exchange involves the services of a third party. These third parties are required to acknowledge the integrity of every deal. They charge hefty amounts for their service.

This amount has to be borne by the traders who are party to the translation. This increases the cost. They are not affordable, so traders have lost interest in centralized crypto exchanges.

On the other hand, decentralized crypto exchanges do not involve paying fees, as the investor independently handles the portal.

As a result, there is less monetary burden on the trader, reducing the overall cost of the deal. These factors play an important role in finalizing the exchange to execute the deals.

All of these factors are weighed down by the investors in taking the decision.

Examples For Centralized And Decentralized Exchanges

| Centralized Exchanges | Decentralized Exchanges |

| Bitfinex | 0x Protocol (Matcha) |

| Coinbase | PancakeSwap |

| Gemini | Uniswap |

| GDAX | Sushiswap |

| Huobi Global | Curve |

| Kraken | Venus |

Conclusion

Based on the examination, it is justifiable to conclude that decentralized crypto exchanges are more useful and return than centralized ones. However, they, too, have their benefits.

They offer a tighter security cover by decreasing the instance of unwarranted speculations and unfair trade dealings. Therefore, an investor has the liberty to decide the type of exchange he wants to deal with. The nature of the expected returns also helps to channel this decision.